Social Security Solution

Rush Limbaugh has been going over a story about tax reform and social security. I just caught some pieces but he was mentioning the idea of eliminating social security or it’s outdated, something along those lines.

Great! I’m all for it.

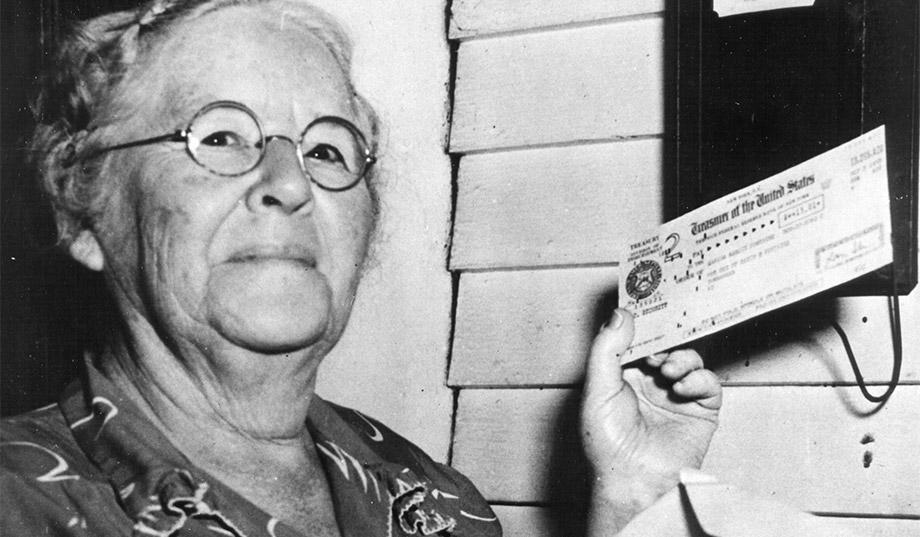

Send me a check for what you stole deducted from my pay check for the last 36 years and I’ll put it to work for my own retirement, I can dump it in my own 401K and let it do it’s thing over the next 15 years of my working life. If I can shake out a minimal return annually I would almost double my money by the time I decide to call it a day.

Seems like a grand idea, where do I sign up?

Of course this will never happen, social security is a scam that’s been pilfering off the middle class for decades with the promise of taking care of you in your old age. Take my advice, take care of your own retirement. You can’t stop your government from stealing from you and you can’t count on them taking care of you, they’re just giving you your money back at a diminished rate after the government parasites have moved it into whatever programs they see fit. It’s all a lie.

6 thoughts on “Social Security Solution”

Hell, they can keep what they’ve stolen from me and my employers (employers match what’s taken from employees, IIRC) as long as they promise never to bother me with their redistribution BS again!

What I’m wondering about a scheme like this is as follows:

Say your pre-tax income is $50,000, and FICA is an even 10%, 5% from you, 5% “from your employer.” Har.

So you get $47,500 pre-tax/after FICA. Meanwhile, your employer kicked in $2,500, making your total value to the company $52,500.

If this FICA stuff goes away, do we expect to see $52,500 in income, or does the $2,500 stay with the company, and our value to the company *drop* to $50,000?

At 75 and having collected since I was 62 I figure I got what I paid in double and I’m planning on hanging around another 10 years.

On the flip side my dad paid into SS since it inception in the 1930’s and passes when he was 64 in 1980. He was going to keep working and hold off on collecting SS till 65. But when he was a little over 62 he found out his cancer was terminal so he signed up right away. In his case the draw of the SS “short straw” didn’t nearly pay him back.

Toejam – Wow that surprises me. Glad it worked out for you.

I paid into SS from the time I was 16 until I was 28, then I worked for DOD and paid into government retirement for 30 years. For the last 10 years I’ve paid into SS again. When I tried to get SS they told me that I was going to get about $50 a month because of the “Windfall” reduction”. I’ll never live long enough to get back what I paid in, much less what all my employers paid in. Wish I had that cash that was paid in to SS over 22 years.

They took SS funds out in the 60’s to pay for the Social Programs. I am afraid the next time they will take the 401k funds like they did in Argentina. Lets face it Obamacare is designed to kill off older people and the Federal Government wants the money. So far Obamacare is not gone and the Federal Government is always greedy.