Public Sector Pensions = City Killers

I worked at a steel plant for eight terrifying months with union employees. I could work circles around most of them but because their badge number had an earlier hire date, I couldn’t move up by out working them. Most people assimilate to the union way….I quit.

The steel plant was a private company, it’s closed now and anything worth taking was sold to China and the plant demolished, ironic huh.

Let’s look at public sector unions. They won’t close the government because China makes cheaper government, but the city/state can be dealt a blow by promises made by politicians on pensions. Democrats love unions because they do the same thing, get ahead using other peoples money.

Hard work used to be the mantra of America, now it’s who ya know, who ya blow, and quid pro quo. Sad.

When economists (those assholes again!) talk about public debt, they seldom mention the mountain of promises to government employees. If I promise you a job and regular raises for the next 30 years, that’s a debt I owe. It is no different than borrowing the money and handing it to you.

Problem is, it’s taxpayer money.

Furthermore, it’s no secret that state and municipal governments face few if any looming financial crises greater than pensions. Some governments have taken piecemeal steps to address this, largely copying moves made by the private sector. More specifically, defined contributions plans like 401ks are now recognized as far more sensible than the rich defined benefits schemes that were once the norm.

So it sounds great but in actual practice it fails miserably. Especially in a stagnant economy.

I can provide the answer here. They cannot be defused. They will explode when the cash runs out in the next decade. I’m not shedding any tears for the workers. They knew, or at least they should have known, that these lavish benefit packages were out of line. They live in the same world as the rest of us. They also know the money for those lavish pay and benefit plans comes out of their neighbors paycheck. To put it bluntly, they have been fucking the rest of us for decades so fuck’em.

Yep.

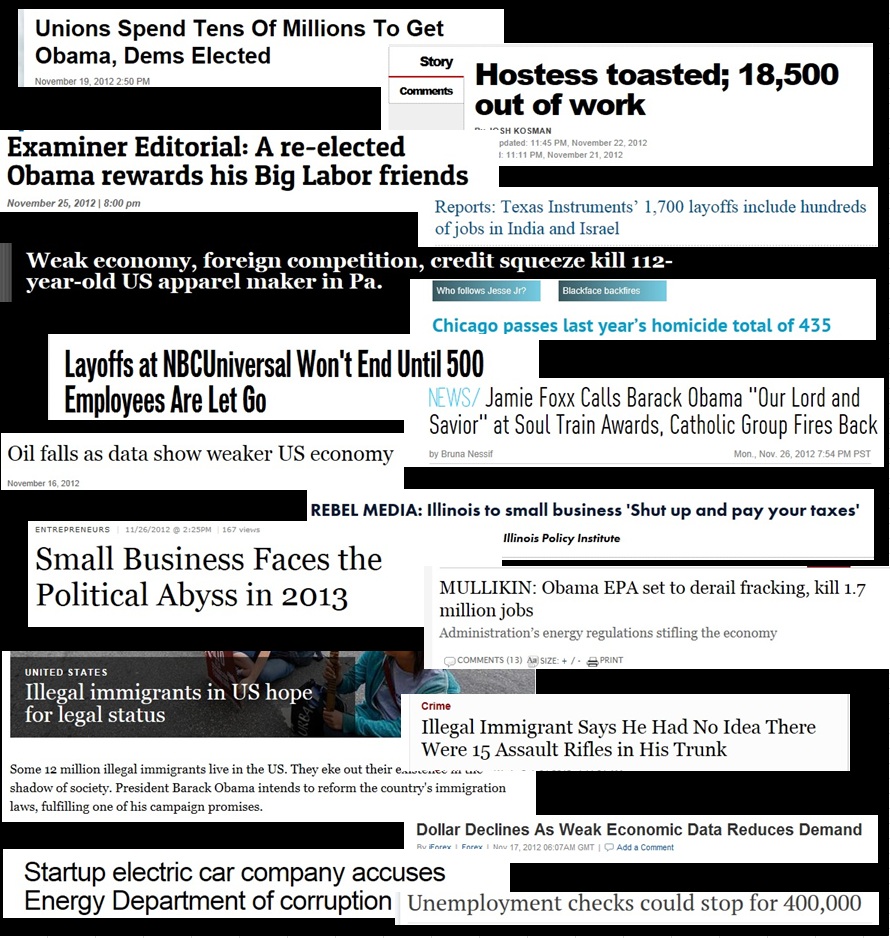

But the relationship between unions – whose power is increasingly concentrated in the public sector – and lawmakers means handsome deals have been struck between decidedly non-adversarial parties. Besides, it all involves other people’s money, and the unions have always provided handsome returns to friendly politicians’ campaign war chests. Taxpayers are now looking at the monstrous bill produced by such cozy extravagance.

It’s always the taxpayers getting screwed.

Louisiana, fortunately, doesn’t have as gigantic a burden as states like Connecticut face. That doesn’t mean it isn’t a huge problem in the Pelican State – to the tune of somewhere between $20 billion or nearly $75 billion, depending on which alarming report you consider more accurate.

Louisiana hasn’t adopted sensible reforms like raising the retirement age and moving to defined contribution plans. Louisiana taxpayers are still stuck with an antiquated and expensive arrangement where the defined benefit plan rules supreme.

In 2012 the Legislature did pass a law requiring future state hires to enroll in defined contribution plans, but led by the teachers’ unions and other interested parties – staffers, boards, lobbyists, investment salespeople, accountants, lawyers and the rest who ride like remoras on this bloated whale – the law was repealed.

What? Repealed? Shocker!

Of course. Letting public employees unionize was never about the state employees. It was about the democrat politicians hoovering off billions in tax dollars through the unions. The hacks running the unions funnel money to the politicians, who play ball. The union jacks also keep a nice share for themselves.

In other words, what Louisiana and practically every other state across this great land faces is a system that is — all together now — unsustainable.

There is no magic fountain. No one will do anything until it is too late. Detroit is the example states will follow. Over the next decade or so services will be reduced and budgets cut in areas like public recreation and road maintenance. Then the first waves of the crisis will hit state capitals. They will force haircuts on bond holders in an effort to contain the crisis. Eventually they will come back to pension plans and force haircuts on them. Some will simply default, passing a change to their constitutions to let them off the hook. The unions will sue, like they are in Illinois, but you can’t get blood from a stone.

What no one considers is those haircuts on bond holders will send ripples through the bond markets. A world built on passing debt around like whores at a biker bar cannot tolerate wholesale defaults. read entire article here